About the Budget

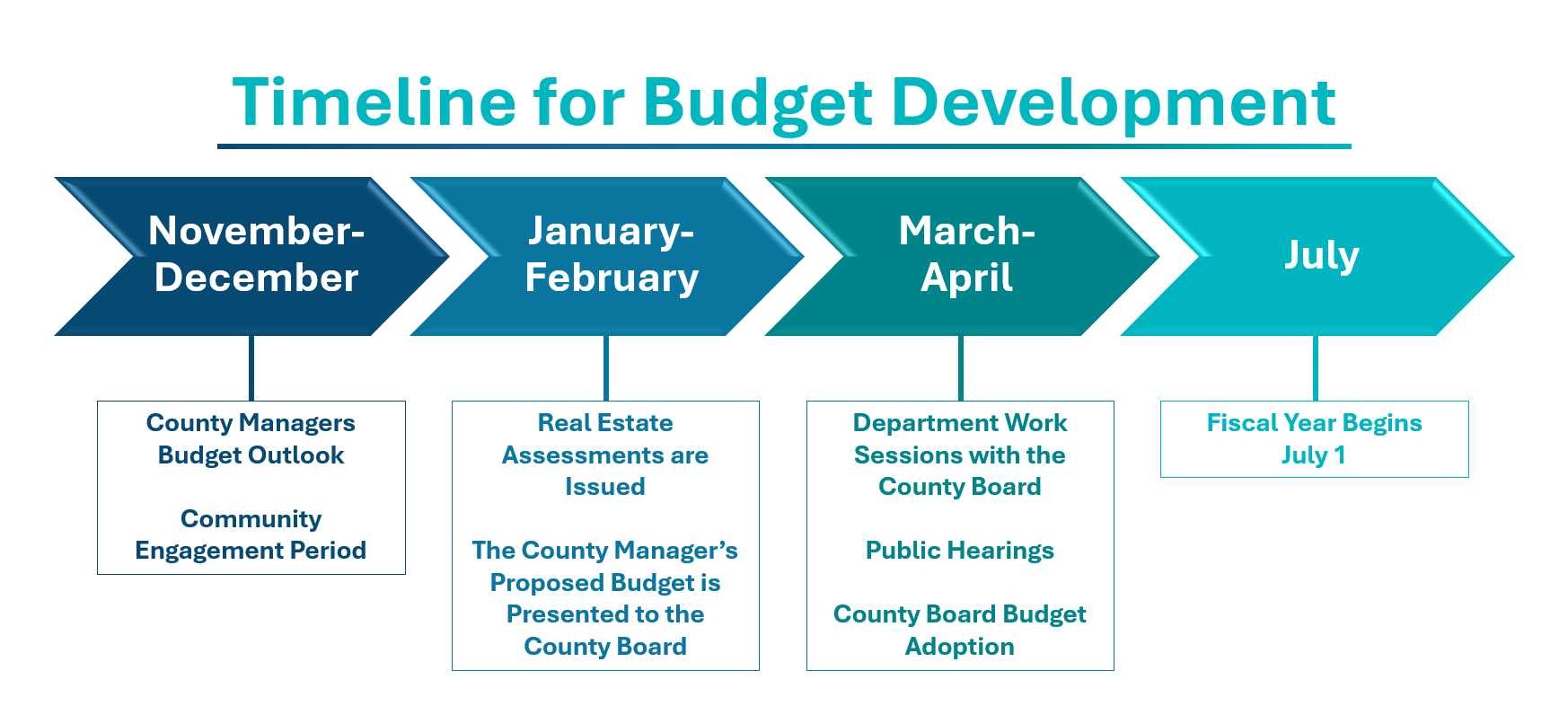

Arlington County’s budget follows an annual cycle, with the fiscal year starting July 1 and ending June 30. The fiscal year budget serves as the annual operating plan and is one of the three major strategic documents in the County regarding planning, in conjunction with the County Comprehensive Plan.

Breaking Down the Budget

November-December: County Manager Gathers Input

The County Manager gathers input from his leadership team, County employees, the County Board, and the Arlington community. This input helps frame and develop the Manager’s Proposed Budget.

Why is community feedback so important?

February: Proposed Budget Release

The County Manager presents his Proposed Budget to the County Board.

Learn how the County Manager develops a balanced budget.

March-April: County Board Gathers Feedback

The County Board hosts a series of work sessions with County departments to learn about the specifics of their budget proposals. The Board also holds two public hearings and gathers feedback online as it considers the Manager’s budget proposal. Sessions are held in the County Board Room, and the public can participate in public hearings virtually or in-person. All sessions are cablecast and live-streamed.

April: County Board Adopts the Annual Budget

Following extensive review and consideration, the Arlington County Board adopts the final operating budget.