On April 9, 2025, the Arlington County Board voted to increase the Meals, Food and Beverage Tax (MEA) rate from 4% to 5%. Therefore, effective July 1, 2025, each provider collecting MEA in Arlington County is required to collect and remit 5% on the total cost of prepared food and beverage sales.

If you have not already done so, please register for a Customer Assessment & Payment Portal (CAPP) account at https://capp.arlingtonva.us/. This online portal will enable you to view and manage your accounts.

For any questions about CAPP or your MEA filings, please contact the Commissioner of Revenue's Business Tax Division by phone at 703-228-3060 or email at business@arlingtonva.us.

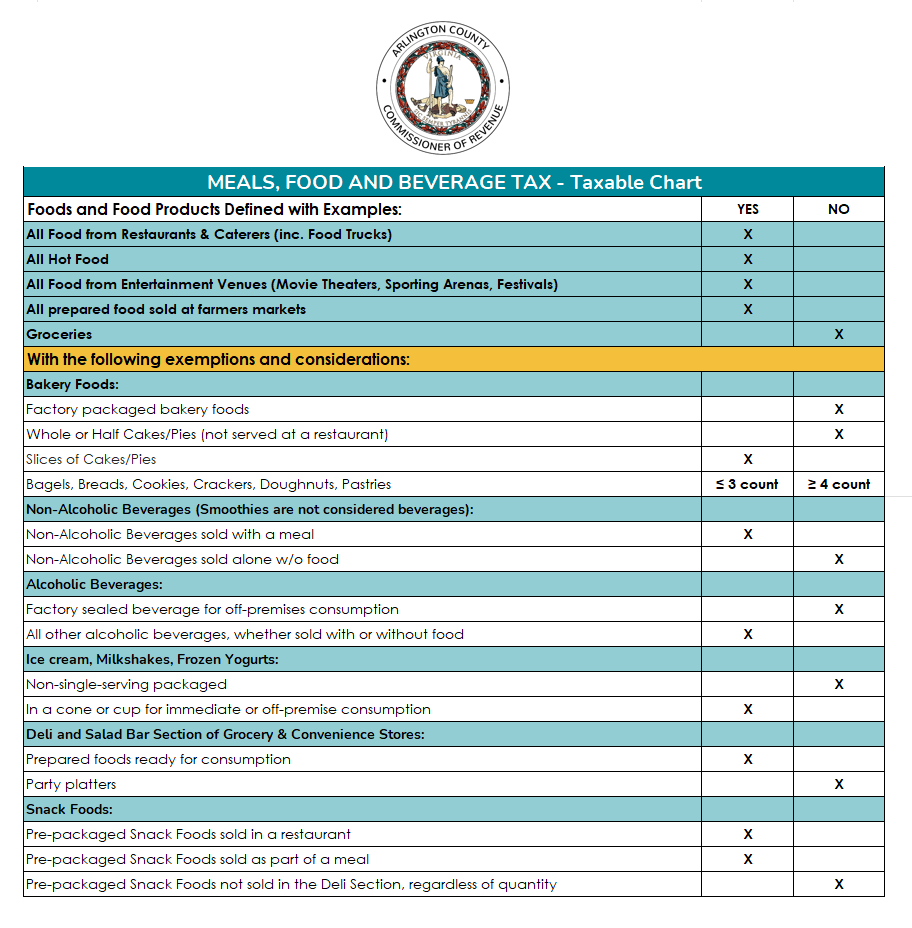

Sellers of prepared meals and beverages (but not grocery items) sold or prepared in Arlington must collect a 4% (increase to 5% beginning July 1) Meals, Food and Beverage Tax (MEA). This tax is in addition to the appropriate state and local sales taxes. This tax is levied on the sale of food and beverages, including alcoholic beverages, whether consumed on or off-premises.

What is taxable?

For more information, please visit Arlington County Code, Chapter 65.

- The Arlington County Commissioner of Revenue considers the restaurant, which prepared the food, to be the "seller" that is responsible for collecting and remitting the meals tax. Any third party delivery service (for example: GrubHub, Seamless, Eat 24, UberEats, BeyondMenu, etc.) is acting simply as an agent for the restaurant that prepared the food. Third party delivery services should be instructed to collect and remit the meals tax (based on the total sales price to the consumer) to the restaurant that prepared the food. The restaurant, not the third party delivery service, will be deemed the responsible party to remit the tax to Arlington County Treasurer. Thus, each Arlington County restaurant is ultimately responsible for collecting and remitting the full amount of the meals tax (based on the total sales price to the consumer) to Arlington County.

- Restaurants or caterers who prepare and sell meals specifically for commercial airlines should charge a 2% food and beverage tax.

- Tax exemptions from the Meals, Food and Beverage Tax are much narrower than the exemptions from the State Sales Tax. Most nonprofits, for example, are NOT exempt from paying Meals Tax even though they may be exempt from Sales Tax. If in doubt about an exemption, restaurants and caterers should contact the Office of the Commissioner of Revenue's Business Tax Division at 703-228-3060 or business@arlingtonva.us.

- A Health License is required for new food establishments or whenever there is a change of ownership, and the license must be renewed annually. For more information, visit the Permits and Licenses area in the Department of Human Services.

For more information:

For more information on custodial taxes, contact the Commissioner of Revenue’s Business Tax Division at 703-228-3060 or email business@arlingtonva.us.